RENTAL INCOME TAXATION

Rental income of natural person is treated as capital income in Finland and taxed at the tax rate in force.

2019 Capital Income Tax Rate

Income Up to €30,000 - Tax 30 %

Income Over €30,000 - Tax 34 %

Please see Finnish Tax Office WEB Pages for more details and up to date information on the Capital Income (rental income) taxation and on how to report it.

Rental income tax rate for Limited Liability Companies is 20% (2019)

Rental income tax rate for Investment Funds is 0% (2019)

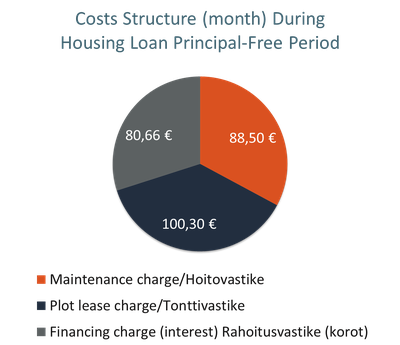

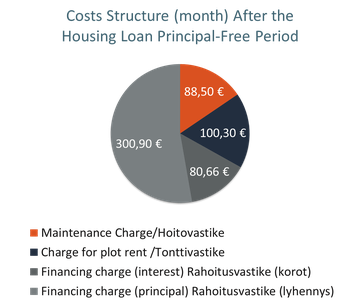

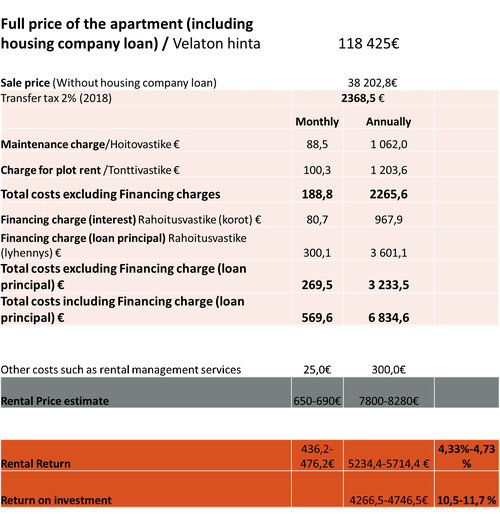

Calculation Example

Based on typical one room (studio) apartment, 28m2 in the apartment block, which rent would be 650-690 EUR/month

Vantaan Mittari Housing Company 02.2019 (location Vantaa, Greater Helsinki Area). Full price is 118 425 EUR

Shall be noted, that the costs mentioned above are naturally deductible from rental income. The Loan principal can also be deductible and often is, provided this condition is set in the article of association of the housing company.

The performance represented is historical and that past performance is not a reliable indicator of future results and investors may not recover the full amount invested.